Originally published in Wealth Mosaic

Following FA Solutions’ article in Swiss Wealth Technology Landscape Report 2020, which was entitled, ‘Automate to accumulate’, Wealth Mosaic went back to FA Solutions to ask them a set of five further questions on what they mean by that and how Family Offices can benefit from increased automation.

Q: Your article focuses on how family offices can add automation to their portfolio management processes. Why is this an important issue for family offices to consider, and how can they benefit most from increased automation?

A typical family office (FO) has multiple custodians and a long-term investment view, with multi-currency portfolios to protect the wealth over the long haul. So, the environment they work in is very complex. This causes lots of potential errors and extended reporting time, leading to prolonged reaction time which may be critical in responding to a crisis. The portfolio managers need to have a firm grasp of the current situation in order to be able to react to significant changes affecting the family’s wealth.

In many cases, their complex structure cannot be manually managed or even delegated efficiently, as only the FO itself has the big picture view of all assets. The only way to achieve efficiency is through automation in gathering, reconciling, and aggregating the required data.

Q: Looking across the industry and how family offices currently use technology, to what extent do you feel the sector engages and effectively uses technology today?

Old legacy systems and Excel are still prevalent, and it is typically difficult for an FO to make the change towards a more modern solution. Even though the management team is often professional and up to speed on industry trends, the organizational mindset is still conservative. The managers have to take this decision to the board, which may not be open to the investment and effort required. They may be concerned with handling the organizational changes that come with implementing a new way of working.

The consequence of sticking with the old way is increased outsourcing – the managers have to put their trust in multiple external managers and custodians for reporting. These will offer different reporting and portfolio management tools as a means of binding the FO to their services for the long term, which will make it difficult to replace them, even if the performance is not optimal and the charges are high.

Q: In your experience, how do family offices approach the topic of using technology in their business, and what are their main focus points, fears, and goals in using technology?

Situation awareness for the shareholders is the goal. Family members of today expect immediate, real-time reporting on any device. This is a hard requirement on a FO that is difficult or even impossible to achieve with Excel or an old legacy system, and even worse if reporting is delegated to multiple custodians. Change is, therefore, mandatory. Most FOs understand this.

But the main fear of the FO when it comes to adapting new technology is that it removes one layer of scattered information to hide behind and brings responsibility to the surface. I know this sounds offensive, but it is often the truth. With a modern portfolio management system keeping all the data easily accessible for the shareholders, performance and fee structures will become apparent – both with their own and outsourced money. Personal relationships behind some managers’ or family members’ selections of funds, custody, and investments will be surfaced and scrutinized. Are they performing? Was it a wise choice? Was it well-thought-out or even intentional to begin with?

Q: What are the key aspects a family office should consider when engaging with technology in their business, and what KPIs should they look to achieve?

The ultimate KPI is to preserve and grow the wealth of the family in accordance with the family’s intentions and goals. A more practical KPI is to achieve correct real-time reporting, available to family members anywhere, anytime. Another KPI is to make sure the selected investment style of the family is followed (e.g., SGI investments preferred) across the mandates.

The short-term perspective KPI is also to stay within the budget of the change process when moving from one reporting solution to another. This process is usually seen purely as an operational cost, but it also brings gain. For example, it is not uncommon to unearth that incorrect fees had been charged in old mandates over long periods of time during the implementation of a new solution.

Q: What is FA Solutions doing as a business to support the automation needs of family offices and other wealth managers?

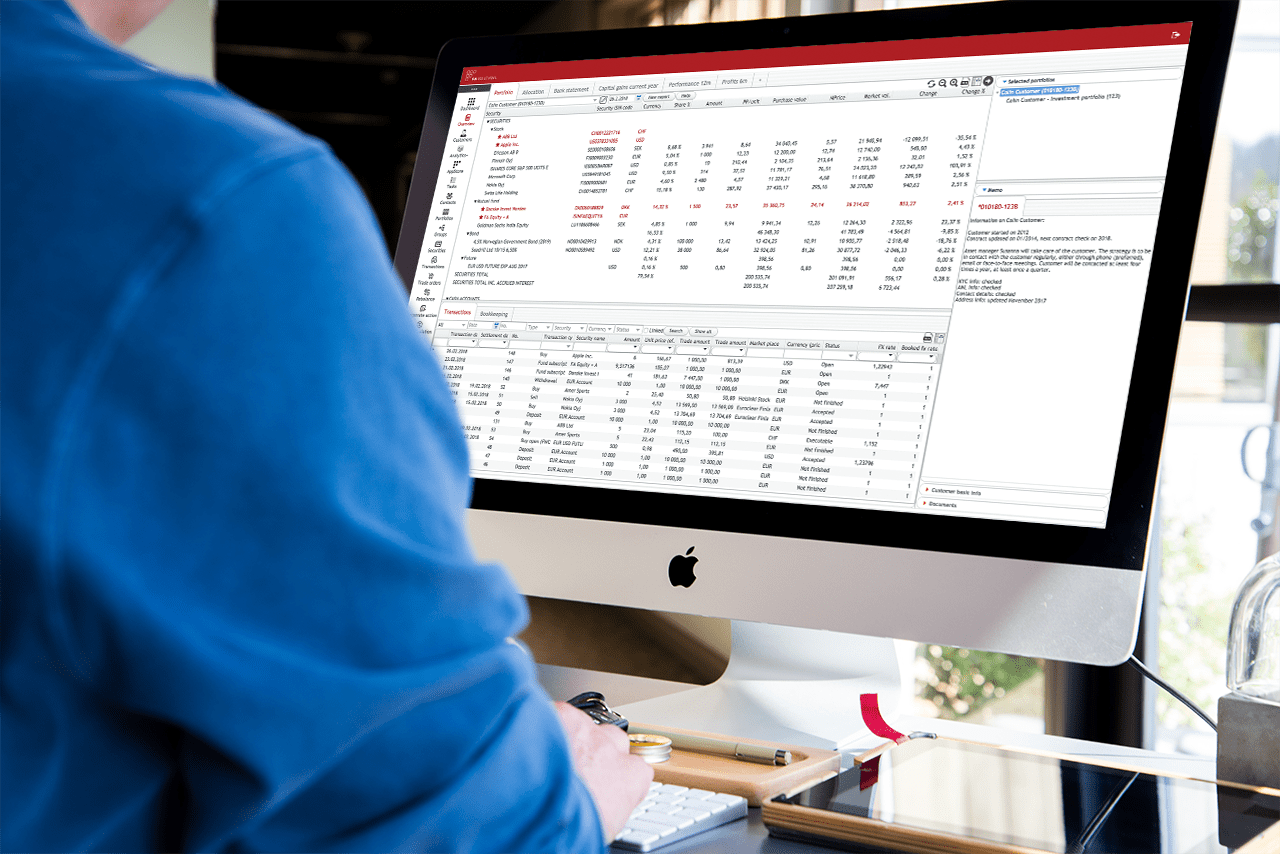

Everything. This is what we do – our bread and butter, so to speak. We provide a cloud-based Software-as-a-Service (SaaS) portfolio management solution, FA Platform, that enables wealth managers to manage all their data in one platform, always accessible on any device. Our product is a modern transaction-based, multi-currency portfolio management system that automates daily tasks such as reporting and trade order management, minimizing human error and helping investment management organizations achieve operational efficiency. The key point is that the reporting is always available and up to date, presented in a suitable manner depending on the recipient.

Download the PDF version of the ‘Automate to accelerate’ article here.