En plattform för Kapitalförvaltning

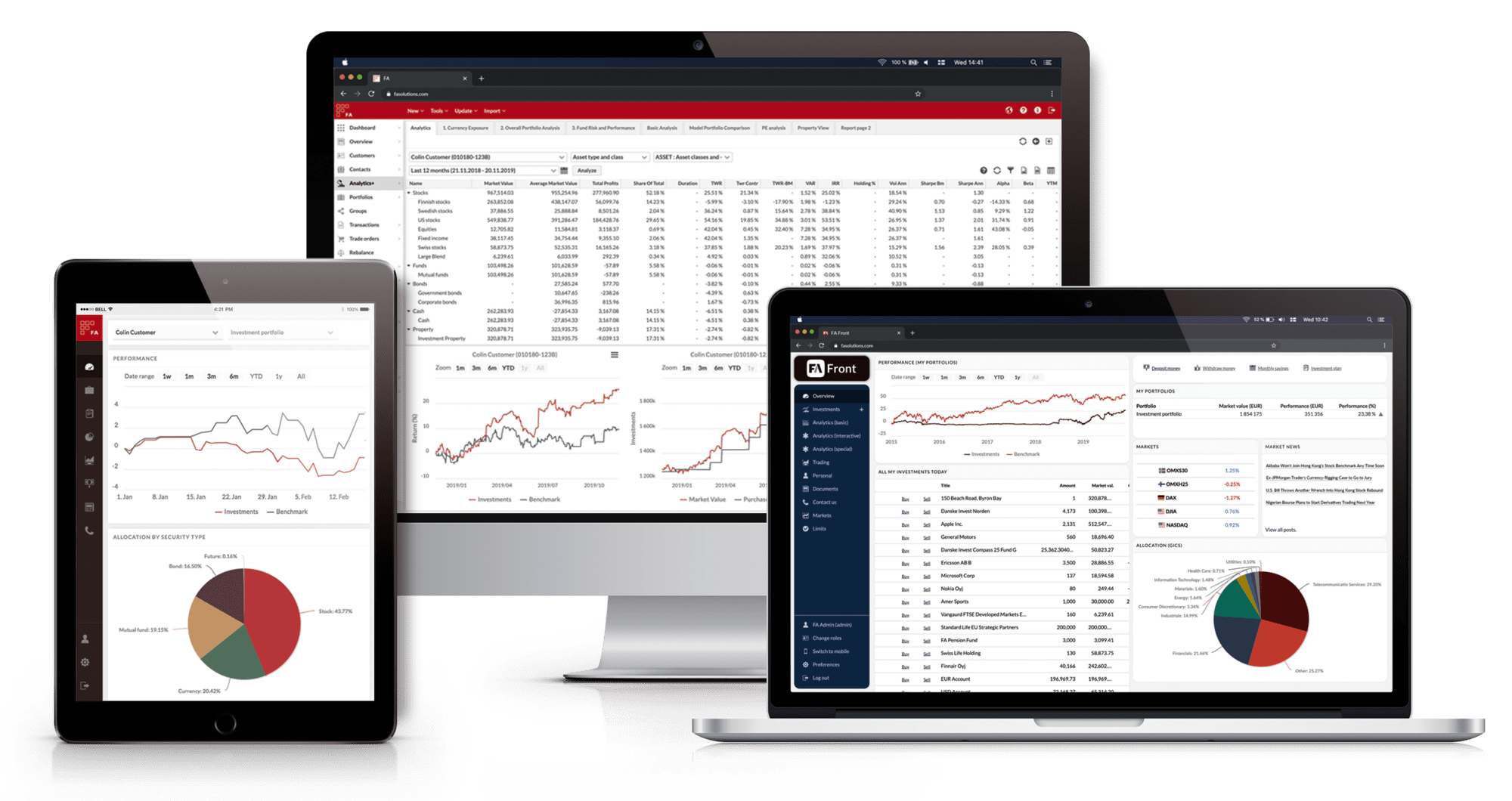

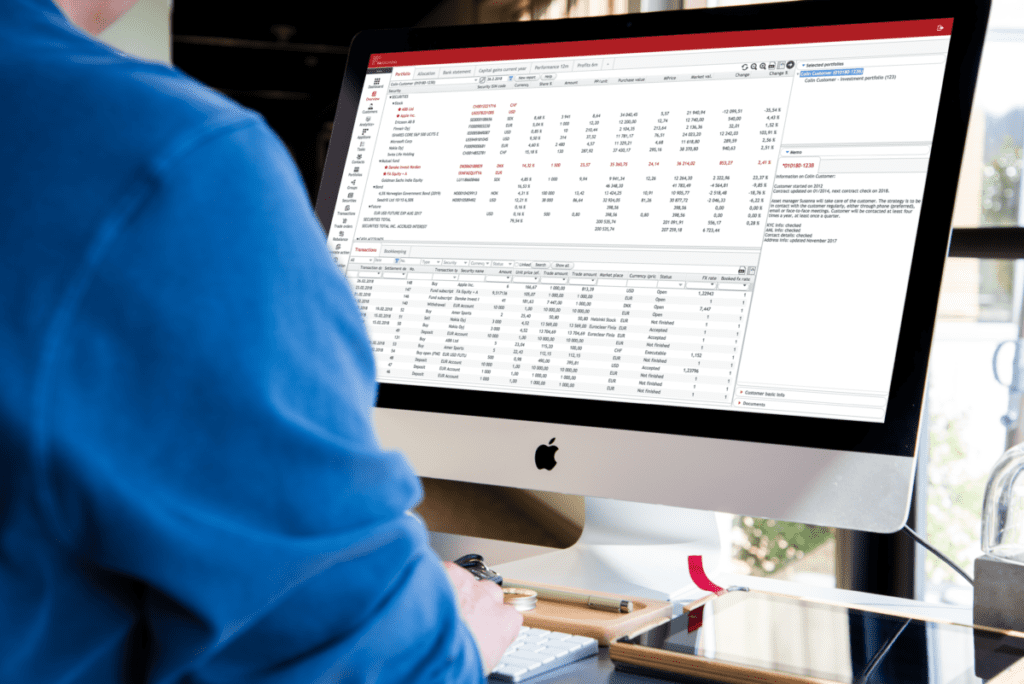

FA är en modern, webbaserad mjukvaruplattform för portföljförvaltning. Det gör det möjligt för företag att ha allt i ett enda system från back, middle-och front office till slutkunder. Med FA:s plattform kan du hantera ditt företag när som helst, på vilken plats som helst och med vilken enhet som helst. Den transaktionsbaserade plattformen hanterar alla valutor med flexibel konfigurering för olika affärsområden och regionala behov.

Plattformen består av moduler, så du kan välja exakt vilka funktioner du behöver för att uppfylla dina affärsbehov. Dessutom möjliggör FA plattformen moderna integreringar för automatisering av processer som handel, rapportering och marknadsdataflöden.

Portföljförvaltning, investeringsanalys, rapportering och kundhantering.

Allt alltid tillgängligt genom en och samma plattform.

Vi arbetar tillsammans er med att hitta bästa lösningen för er verksamhet.

Vi möjliggör att ert företag alltid är tillgängligt oavsett enhet.

Med oss kommer ni att ha en investment management plattform som växer med er verksamhet.

Vi stöder er under implementeringen och därefter.

Med oss har ni alltid den senaste versionen av programvaran. Det ingår i priset.

Några av våra kunder

“Vi ville ha ett modernt system med bra rapporter, enkelt att hantera och för en rimlig kostnad. Att kunna strukturera våra klienters portföljer på olika nivåer var och är väldigt viktigt! Efter att noggrant gått igenom marknaden blev FA Solutions vårt val!”Bobby Weijmar, Adecla

“Erbjuder helhetslösning samtidigt som användaren har frihet att skräddarsy det för sitt syfte – Smidig och pålitlig NAV-process.” Ken Söhrman, Ansvarig Back Office på FCG Fonder