It is not far-fetched to compare customer relationships in asset management into rocket science, as we did somewhat a week ago in our recent breakfast seminar in Helsinki. Currently customer relationship management is facing transitionary times: while digitalization is renewing processes and practices, customers are gaining unparalleled power and regulators are tightening their grip by renewing data security and privacy laws. Handling customer relationships itself isn’t an easy task, and especially in finance the heavy regulation is adding its own extra spice by increasing the complexity one step further.

There are many layers in customer relationships. The whole relationship starts with a prospecting phase: Either you contact the prospect or they contact you* through many of online and offline touchpoints, such as social media, events, cold calling, recommendations, advertising campaigns… Therefore, you should consider on the strategic level: Where are you visible and to whom? How do you stand out from the crowd?

*this actually is getting more common due to information flow in social media and digital communities, and you should really make sure you have your 15 minutes of fame there

After you have identified that there is sales potential in a particular case, we can start talking about a lead. You will start working closer with it. To be able to work efficiently with the lead, all information from the prospecting phase should be available. This is the first step where you wish your CRM system is advanced and integrated enough to be up to date. This milestone also provides multiple touch points in interacting with the potential customer, online or offline. Before making an offer, you need to verify the customer’s identity, collect the very basic personal details, learn about the lead’s previous experience, risk tolerance and objectives, and not to forget to ask for the capital origin as well as political linkages (AML & PEP). How this happens: Offline, online, or a combination perhaps?

The Rocky Road of Regulation

When the lead is mature enough for you to send out a binding offer, you need to be sure the offer combines all the aspects: it is in line with the objectives, risk level and allowed investment products for this customer. All this needs to be properly documented and fulfil multiple regulations, such as MiFID II, KYC, IDD, PRIIPs, CRS, FATCA, and soon also GDPR… As nice as getting a new deal is, this unfortunately also means the beginning of the red tape. KYC, Know Your Customer, has become more into KYD, Know Your Documents.

As nice as getting a new deal is, this unfortunately also means the beginning of the red tape. KYC, Know Your Customer, has become more into KYD, Know Your Documents.

After a legal agreement is signed and a lead has become a customer, of course the customer relationship has to be taken care of, not only from the regulatory perspective but also to nurture the newly born relationship. This includes activities such as reporting, communications, occurring changes on both sides, and cross sales. This kind of interaction can be initiated by the asset manager or the customer, and can happen over various contact points, such as meetings, calls, messaging, and online. There are at least three critical tasks to be managed at this level: First and the most critical being taking care of statutory reporting obligation, which is only getting greater after MiFID II implementation; the second is to offer customers the means to serve themselves as in the modern world by accomplishing the simplest tasks online, without having to burden your personnel (which in fact can be more of a burden for the customer…); and third is the ability to identify opportunities for additional sales.

Again, for the sake of KYC and KYD, all these regulations, and just the ability to provide better customer experience and identify sales opportunities, you once again wish your systems are advanced enough to store and process information so that you can consider on what’s more important – working with your clients instead of the red tape.

Are You A Prisoner of Your Own Segment?

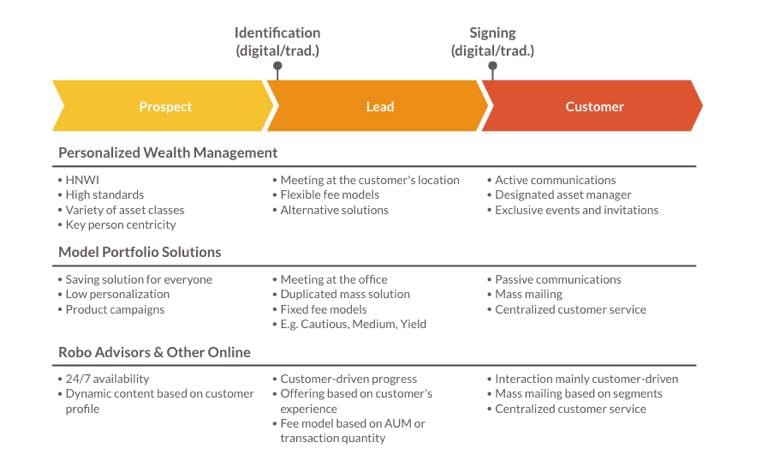

Businesses and customer types are varying from highly individual wealth management into model portfolio solutions for masses. Traditionally you would probably think that in a highly personalized wealth management for HNWI segment this means meetings in customer’s location, whereas in case of a robo advisor, the lead or customer would proceed through a digital onboarding process and online service portal designed to handle masses of clients.

« Interaction points and channels during the life cycle of three different asset management customership scenarios

However, things are not this black and white, as modern technology allows new approaches. Instead of just locking yourself into a category, innovate more freely by mixing the elements of customer interaction. Even those clients that have traditionally been on the top priority level of your service, also known as the very wealthiest, are increasingly asking for more and more time and place independent online services and 24/7 access to their investments.

The table above is filled with example customer interactions in different business segments. Instead of following strictly the interactions in one segment, try picking the best parts from each segment to combine your own, unique mix of customer interactions.

How are you different from others and serving customers better in the digital era? What is your unique mix of customer interactions?