For immediate release. Originally published in Wealth Mosaic.

“Diversification helps in reducing risk and increasing long-term returns. Yet it makes portfolio management and performance reporting extremely complex, especially if unusual investments such as collectibles or philanthropic projects are in the mix.”

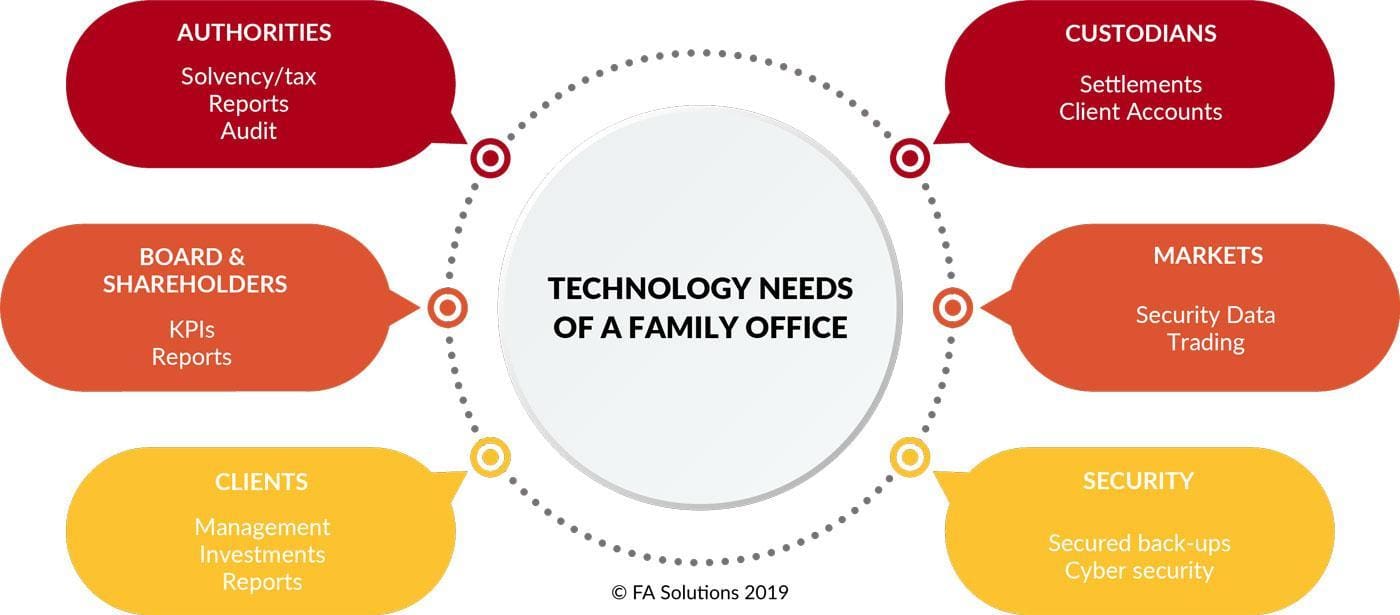

Figure 1. The technology needs of a family office

Figure 1. The technology needs of a family office

The Swiss wealth management industry has seen a dramatic increase in single and multi-family offices in the past years. The current count is over 450 companies, according to Foss Family Office Advisory. That is not surprising, considering the country provides an economically and politically stable environment with easy access to highly skilled labour as well as modern financial services. Most importantly, the tax regime in Switzerland remains one of the most favourable for corporate entities and ultra-wealthy individuals. All these factors have contributed to the longterm rise of the Swiss family office.[/cs_text]

Diversification helps in reducing risk and increasing long-term returns. Yet it makes portfolio management and performance reporting extremely complex, especially if unusual investments such as collectibles or philanthropic projects are in the mix. Involvement of multiple custodians and different family members with individual investment goals further complicates things. Failure to manage this complexity can become a serious barrier to profitability.

I am focusing more on the operational side of financial investment management (rather than family governance, succession planning, etc.). Some of the key challenges arise from the broad range of asset classes, investment strategies, and instrument types that are available to a family office, which will usually have a long investment horizon and access to highly skilled investment professionals.says Hjalmar Bøe, ex-head of compliance and middle office at Höegh Capital Partners, currently establishing his own investment advisory, Yalmar.Bøe added, “The ‘endowment’ approach, with high focus on illiquid, alternative, and unlisted investments will further move the portfolio out of the comfort zone of the traditional service providers (banks, software, consultants). When these dimensions are combined with mandates and portfolios from different family members and investment companies, the result is a significant multi-faceted operational challenge.

Furthermore, Family Offices will usually be somewhat conservative and operationally risk-averse, often putting in place sound governance structures. This, in my experience, results in a portfolio that is high in complexity but lower in transaction volume and trading frequency.”

Bøe also added, “Adding to the challenge is the often sophisticated and specific reporting requirements arising from working closely with family members who usually have informed views of portfolio characteristics, strategies, and risks. Portfolio reporting should also be dynamic and able to keep pace with changing market trends, new investment strategies and instrument types that are put in place to exploit these.”

Technology can assist in automating internal family office processes.

Unfortunately, not many wealth management tools will meet all the complex needs of an organization. Indeed, a main motivation in finding a new portfolio management solution is finding a more modern platform that can handle all investment types.

In particular, it is cumbersome to re-key data multiple times, so automating data feeds is an important factor, as well. Overall, the goal is to stop using multiple tools for different tasks and having to maintain spreadsheets in addition to the asset management platform. On the reporting side, it is crucial to deliver monthly reports faster and in a more independent, self-service way. In addition, there is a need to access reports online and on different devices.

As shown on Figure 1, an all-encompassing tech solution should not only take care of core portfolio management tasks, but also provide support for multiple custodians, reporting to authorities as well as family members, accurate accounting, and cyber security plus backing up of the data

Managing data from multiple custodians – the big issue

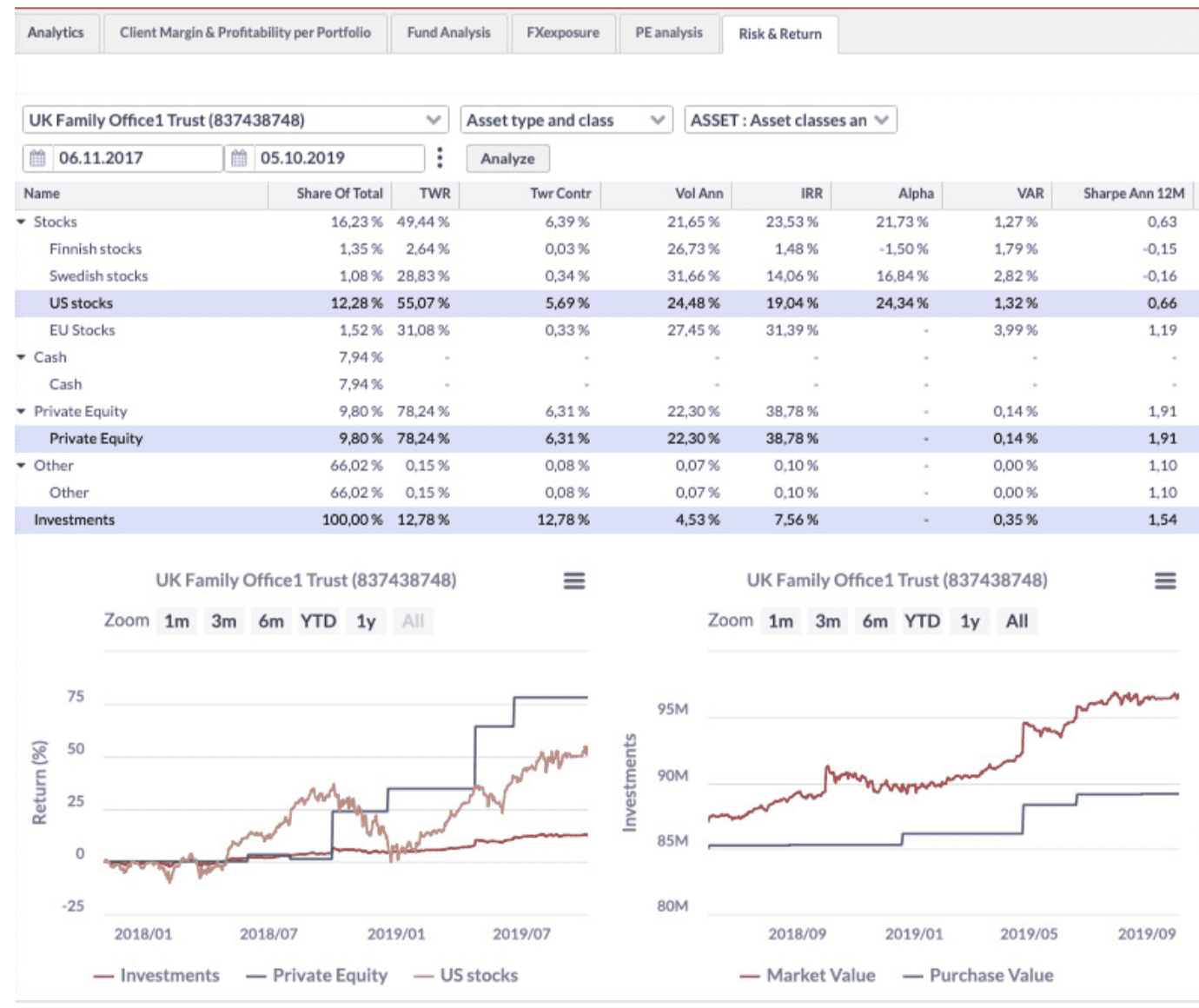

One of the leading drivers of complexity in wealth management for family offices is having to manage multiple different custodians. If a family office outsources some or all of the investment management to one or many asset managers, a major problem arises: how to aggregate the data and make sure that managers stick to their mandate and provide the returns accordingly. Controlling fees is also an issue. Figure 2: Analytics view in FA Platform for multiple portfolios combined to create total risk & return

Figure 2: Analytics view in FA Platform for multiple portfolios combined to create total risk & returnAsset managers normally provide an interface to see the investments, but the family office will typically want to get the full and consolidated view from all the mandates distributed, and see the total allocations, returns and risks, not just for one at a time. The only way to achieve this is to harvest the transaction data from each manager, and aggregate in an integrated portfolio management system. This is far more complex than one may first think though, as the manager may be very active and introduce new securities that have corporate actions linked to them, or that the family office has no knowledge about.

How can platforms like ours support reporting on multiple asset classes from multiple providers, as expected by a modern family office? Something important is the ability to add asset classes, as well as define transaction types and see their effects on the overall portfolio quickly. The rest of the solution, including reporting, risk management and generation of bookkeeping should automatically support the new asset type.

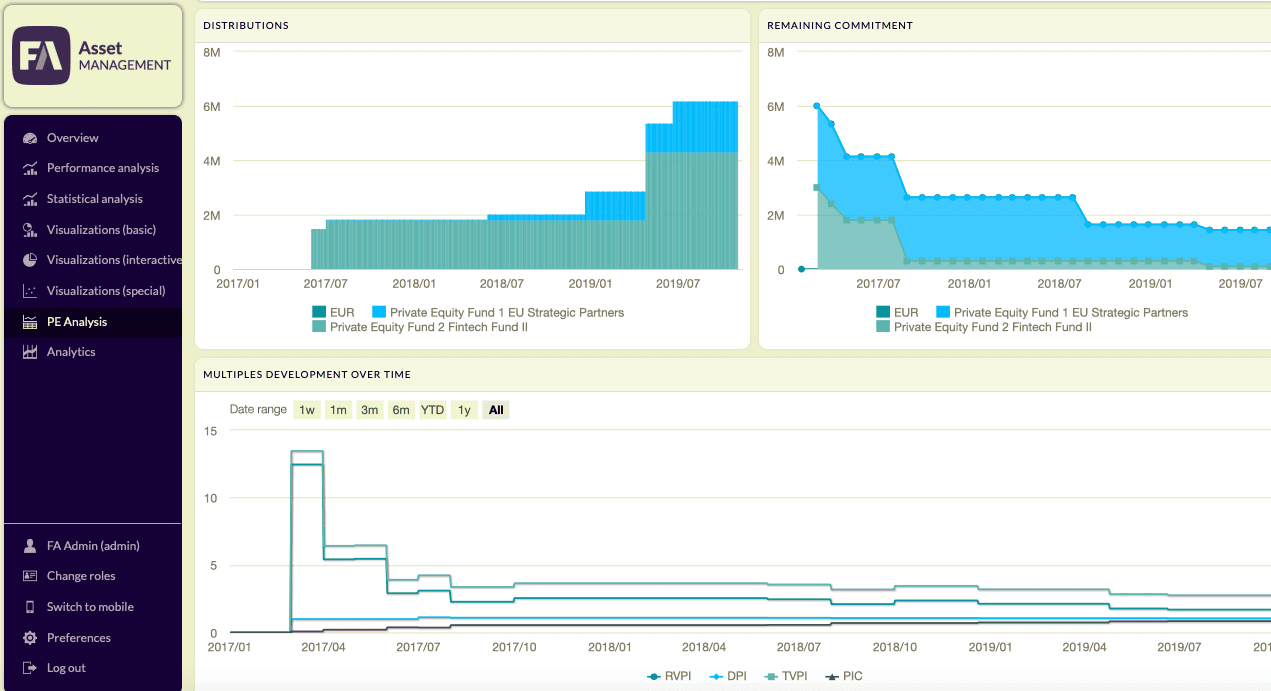

A good solution should be able to deal with alternative investments such as private equity, real estate, wine, and more. This means that the family office can report all assets to their family members on the web, in real time and focus on the asset class of interest right now, as shown in Figures 2 and 3.

Based on our research, it is clear that family offices in Switzerland need to concentrate on finding a portfolio management solution that simplifies and automates their internal processes, while also staying on top of the coming trends about to revolutionize their sector, like the growing influence of millennials on the financial industry.

As the Generation Y plays an increasingly important role, family offices need to meet the challenge of increased requirements towards their technological savvy and in particular flexible, frequent reporting.

Figure 3: Private equity analysis view in FA Front

Figure 3: Private equity analysis view in FA FrontDownload the PDF version of this article here.

This article originally appeared in The Wealth Mosaic’s 2020 Swiss Wealth Technology Landscape Report. Click here to access and download this report.