Article originally published in Bobsguide

In the Back offices of banks and asset managers around the world there are multiple functional entities and processes, which in time, have grown separately and developed their own bottlenecks. The 21st century has introduced topics such as customer experience and regulatory burden, which the existing back office setups do not necessarily support. For example, jumping from a system to another causes a fragmented audit trail and hampers automation which in turn is an obstacle for a fluent (digital) customer experience.

Improve efficiency and customer experience beyond 50%

Streamlining and digitizing back office processes is necessary for companies that wish to stay on top of the game in this new environment. Technology can help in both, automating processes (such as digitizing workflows and supporting decision-making) as well as managing procedures that must be carried out manually. According to McKinsey&Co, a significant opportunity exists for increasing the levels of automation in back offices. By taking a full advantage of this approach, companies could improve their efficiency and customer experience beyond 50 percent.

The McKinsey&Co research exposed the most common obstacles to creating back-office automation. The first is that companies rarely have a proper understanding of all the processes and workflows within their back office. For too long the priorities have been in enabling growth or launching new products and services – by adding a layer on top of another layer – just to be able to get it done without having a proper system support. Second, the above-mentioned reasons along with the regulatory changes and possible mergers and acquisitions in the company history may also have fed an illegible IT architecture spaghetti to their employees. This has led into complex, multistage, and multi-system processes which are difficult to automate. It does not support growth in long-term.

The third obstacle is the lack of internal capabilities, different agendas, or priority misunderstandings between the local IT departments, actual business needs, and external IT vendors. Instead of resisting and being afraid of losing their jobs, the IT department should adapt to the new age: Product vendors or business units are not able to implement systems on their own. The current age requires just new kinds of skills: IT experts should be able to work seamlessly and speak the same language with business and operations, run agile projects, and be able to choose and implement the right solutions (or, if necessary, develop in-house). It is, still, all about people and IT working together.

– Human errors, misunderstandings, and lost information

– Inaccuracy of data

– Hours spent on red tape instead of the business itself

– Impossible monitoring and reporting processes

– Lack of audit trail

– Frequent inconveniences to stakeholders

– Missed deadlines

How to get started?

In the middle of this clutter it can be confusing to find a starting point, but as you strip it down, it is just a matter of prioritization – putting some work hours of the relevant people to the task. In these kinds of projects, it is important to enable cross-team cooperation. Involve experts from IT, business, and operations, but also from top management.

Start off by mapping your processes, which creates a digital roadmap. To exemplify, a large universal bank started by mapping and categorizing their 900+ end-to-end processes into three ideal states: fully automated, partially automated, and (lean) manual. Other bank used pretty much the same three categories, but classified the end-to-end processes by using four tests that determined the following:

– Is the process too complex to automate (e.g. deal origination and structuring)?

– Do regulations require human intervention (e.g. the financial-review process)?

– Is the process self-sufficient, or is it dependent on multiple customer or third-party interactions?

– Do manual touch points within the process add value to the customer relationship?

These questions help you to get started. You can edit them to be more suitable to your needs, or even come up with your own metrics.

After mapping all the processes into categories, it is easier to start off the digitization process with a set of related processes. Instead of doing everything at once, this kind of an approach brings you various benefits: it is easier to implement and ensure that everything has gone well, the success (or failure) is easier to notice and measure, and you are not too engaged into the new system if it for some reason does not work for the intended purpose.

Despite the one-at-a-time approach, if the solution turns out to be successful, an ideal situation is that it would also support the digitization and automation of other processes. This would enable bringing everything into one platform, step-by-step, to avoid the system change and process redesign hitting the company like a ton of bricks.

Why take everything into one platform?

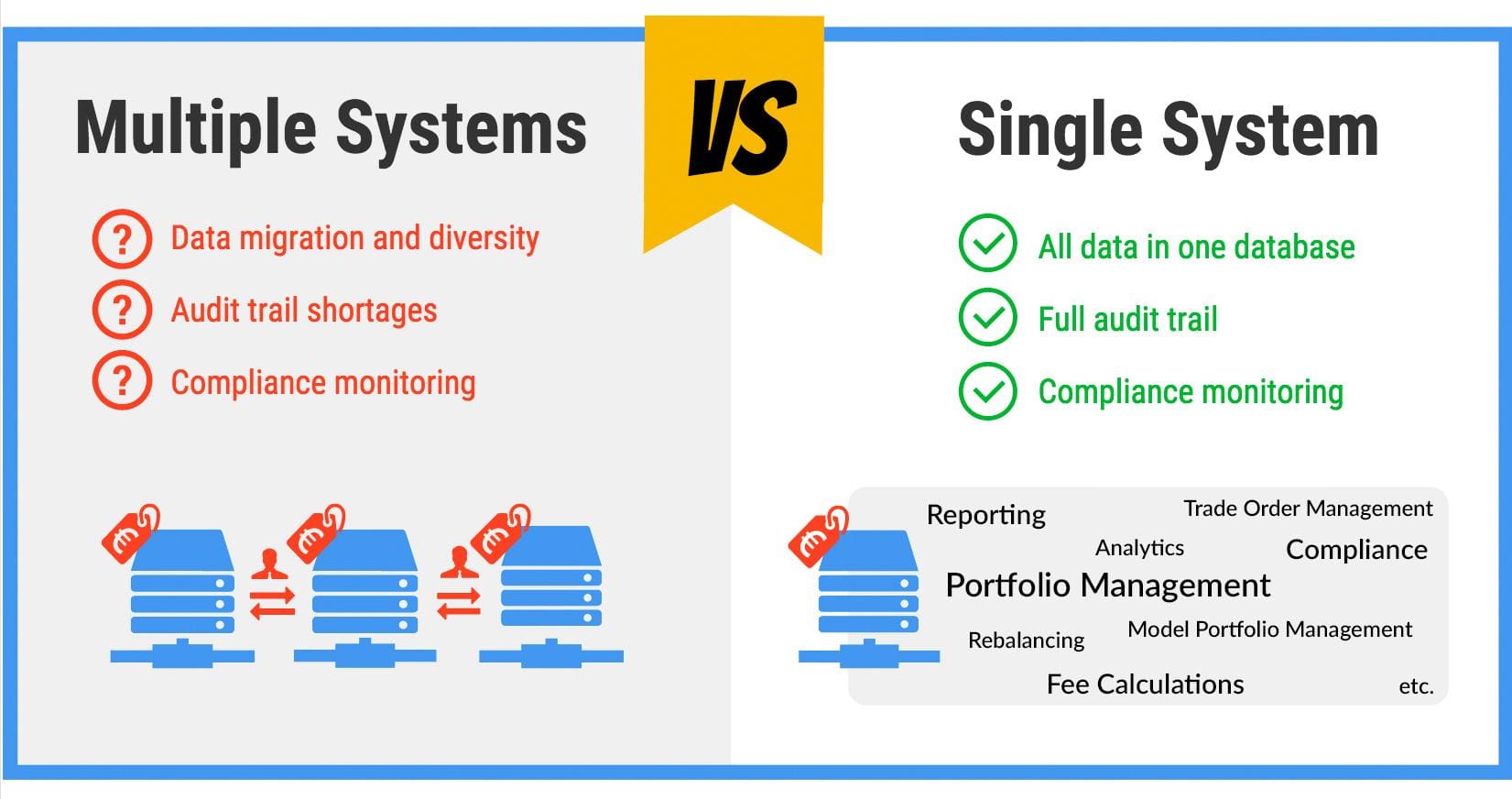

Typically, multiple tasks in back offices (and throughout front office and end clients) are conducted in different systems. This division does not support efficiency for three reasons: First of all, maintaining multiple systems and integrating them generates extra costs. Second, when tasks are spread into multiple systems, automating processes and information flow is difficult. Finally, the probability of errors increases due to data differences or defects between the multiple systems on the instrument, transaction, or customer level. Staying compliant in the current regulatory environment is also an issue: you lack a proper audit trail that covers the whole process, you are exposed to human error, and you face difficulties in following customer-specific strategies and restrictions.

Multiple outdated systems erode the profitability of investing. To achieve efficiency, a high level of process integration and automation is crucial. This is a problem we want to address by bringing the entire back office into a single system. Having everything in a single system eases process automation, reduces manual work, and ensures data accuracy with audit trails. When you don’t need to maintain multiple systems and transfer data between them, you can focus on more important aspects of your business and free resources from IT.

A central question that many companies should ask themselves is: Are we an IT company or an Asset Management company?

Just leave your contact details below if you wish to learn more about how FA Solutions can help you to automate back office processes.