FA Solutions launched its first webinar, FA Talks, a thought leadership series covering the issues affecting wealth managers. Hans Martin Aulie, Senior Business Architect at DNB Markets, and FA Solutions’ Partner Richard Nordin joined an interactive conversation with participants from the industry about business continuity to help managers overcome disruption, covering their experiences so far and how others can replicate.

COVID-19 is unprecedented and will likely drag the world economy into a recession. In a recent Greenwich Associates survey1 on information investors find most useful from managers, 69% of respondents value specific information on how their personal portfolios will be affected. This will force managers to change how they serve investors and revise business continuity plans.

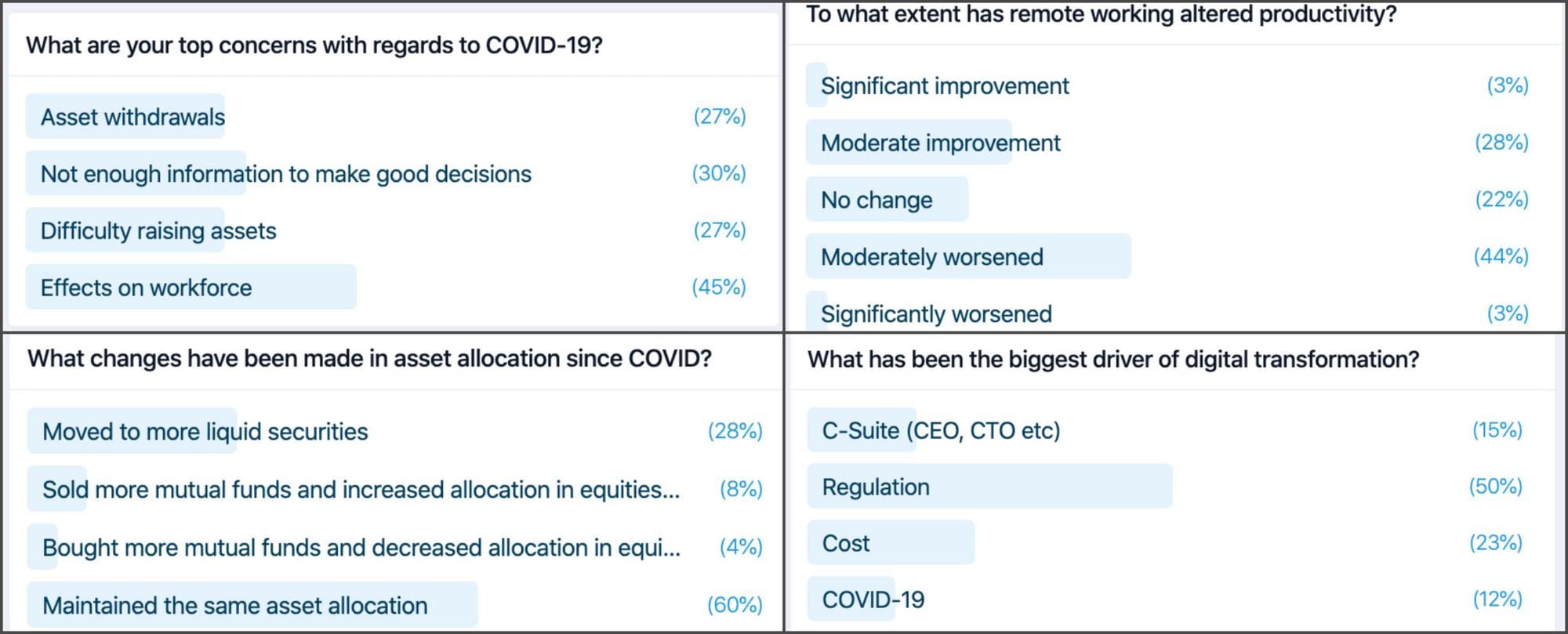

Our webinar audience shared their biggest concerns of COVID-19, with 45% of respondents most concerned about the effect it will have on their workforce. Hans Martin described it as a “black swan” given business continuity plans have not envisaged all employees working remotely, but remains optimistic this will be resolved soon and ultimately accelerate the move to digital collaborations. However, he concedes that organisations cannot fully overcome the challenges of remote working, because of technological barriers. Evidently, 47% of participants have seen their productivity decline marginally or significantly.

The limitations of remote working have made it difficult for firms to proactively acquire new clients especially if they are not tech-savvy, therefore more reliant on inbound demand. However, Richard Nordin from FA Solutions argues that tech-illiterate clients will be forced to adopt digital channels. Hans Martin pointed to the importance of servicing existing retail clients as they have been net buyers, trading volume at DNB Markets year-to-date has surpassed 2019 volume. Despite an overall increase in trades, 60% of attendees did not see changes in asset allocation.

Wealth managers may consider making strategic tech investments to improve the delivery of services, for example, Hans Martin suggested investments to fix bottlenecks such as high-volume trading. Richard warned against short-term investments, although both admit that future-proofing of investments is very difficult, but they are certain that regulatory changes are inevitable. In fact, 50% of attendees believe regulation is the biggest driver of digital transformation, as opposed to 12% who believe it is driven primarily by COVID-19. Richard strongly emphasised that regulatory pressure will only increase the cost burden on the industry.

Recent events have proven that the wealth management industry is largely intact and volumes will continue to increase. The crisis has revealed the flaws in the technology offering to clients and will only make client acquisition difficult if not addressed. It seems COVID-19 is not the driving force for digital transformation but rather a catalyst that will have a profound effect on how the industry will serve investors.

If you are interested to hear how our product, FA Platform, simplifies daily operations and helps wealth managers provide superior service to investors – just drop us an email at sales@fasolutions.com and we will be happy to guide you through our solution to see if it fits your specific business needs.