Investment managers are evaluating how to leverage technology to offer a differentiated service and improve the customer experience. FA Solutions shares insights on how we connect to external platforms for a cost-effective route to digitising wealth management.

The wealth management industry has begun to scratch the surface of the potential of digital wealth. This is in part due to a squeeze in profit margins due to end investors becoming more price sensitive, coupled with wealth managers tapping into a new generation of investors that are more accustomed to digital applications. We begin to see a glimpse of how wealth managers are embracing digitisation as COVID accelerates this transformation.

The case for digitisation

There is an incentive to shift wealth management to digital platforms, however, the industry remains hesitant due to the perception of costly investments. The financial services industry is heavily regulated and participants are therefore risk averse, this is changing because MiFID requires labour intensive compliance. Due to the lack of interoperability between third party systems it has been costly to maintain. Richard Nordin at FA Solutions asserts that “automation as opposed to manual labour can help lower costs”.

There is a misconception that digital platforms need to replace legacy systems and consolidate functions. No single provider offers expertise across all functions to streamline workflow. FA’s modular nature automates functions in the background and sends data to an external layer or vice versa, which could be an inhouse or third party platform that is more cost-effective. For example, FA’s bookkeeping module can connect to an accounting system that provides a more comprehensive outcome. Integrations are powered by APIs, an interface that communicates with other systems to send or retrieve data.

There is a misconception that digital platforms need to replace legacy systems and consolidate functions. No single provider offers expertise across all functions to streamline workflow. FA’s modular nature automates functions in the background and sends data to an external layer or vice versa, which could be an inhouse or third party platform that is more cost-effective. For example, FA’s bookkeeping module can connect to an accounting system that provides a more comprehensive outcome. Integrations are powered by APIs, an interface that communicates with other systems to send or retrieve data.

Testimony from Centology

In a recent webinar hosted by FA, we spoke to David Stamp, founder of Centology, to talk about his reasons for partnering with us. Centology was built as a self-service platform for external IFAs that offers the complete workflow, from relationship management to trading. David’s team were able to build a front end interface in house but lacked the expertise to develop middle and back office functionality and were therefore looking to partner with “best of breed systems”.

FA’s strength lies in middle and back office functions such as rebalancing. By focusing on their strength, Centology has the flexibility to scale their client base to tens of thousands whilst minimising underlying costs. This can be achieved by automating functions provided by FA, which includes generating trade orders in FA, updating transactions from a custodian and feeding portfolio positions back to Centology.

FA’s strength lies in middle and back office functions such as rebalancing. By focusing on their strength, Centology has the flexibility to scale their client base to tens of thousands whilst minimising underlying costs. This can be achieved by automating functions provided by FA, which includes generating trade orders in FA, updating transactions from a custodian and feeding portfolio positions back to Centology.

Future of Wealth Management

Technology providers are of the view that there is no need to “reinvent the wheel”, but reducing the implementation cost can help democratise digital wealth management. This is a positive step for smaller firms and millennial investors as barriers to entry have traditionally been high. David Stamp’s goal was to provide advisers and clients with greater access to live data to improve the client experience, but most importantly, to lower costs for end-investors.

As wealth managers integrate with best-in-breed systems to increase automation, they have the flexibility to adapt to new technology. This opens a new conversation on the limitations of human input by embracing AI and machine learning. For example, FA has explored its use in anti-money laundering, being able to search through very large sets of data to detect anomalies at a much faster rate than humans can. In conclusion, FA envisages future wealth managers being less reliant on outsourcing services and migrating data and technology to the cloud.

As wealth managers integrate with best-in-breed systems to increase automation, they have the flexibility to adapt to new technology. This opens a new conversation on the limitations of human input by embracing AI and machine learning. For example, FA has explored its use in anti-money laundering, being able to search through very large sets of data to detect anomalies at a much faster rate than humans can. In conclusion, FA envisages future wealth managers being less reliant on outsourcing services and migrating data and technology to the cloud.

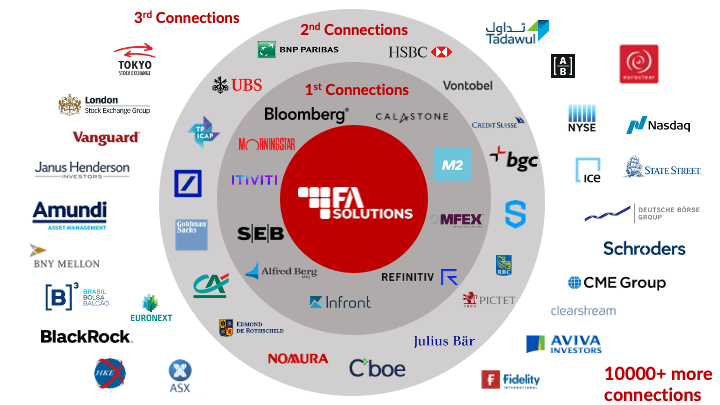

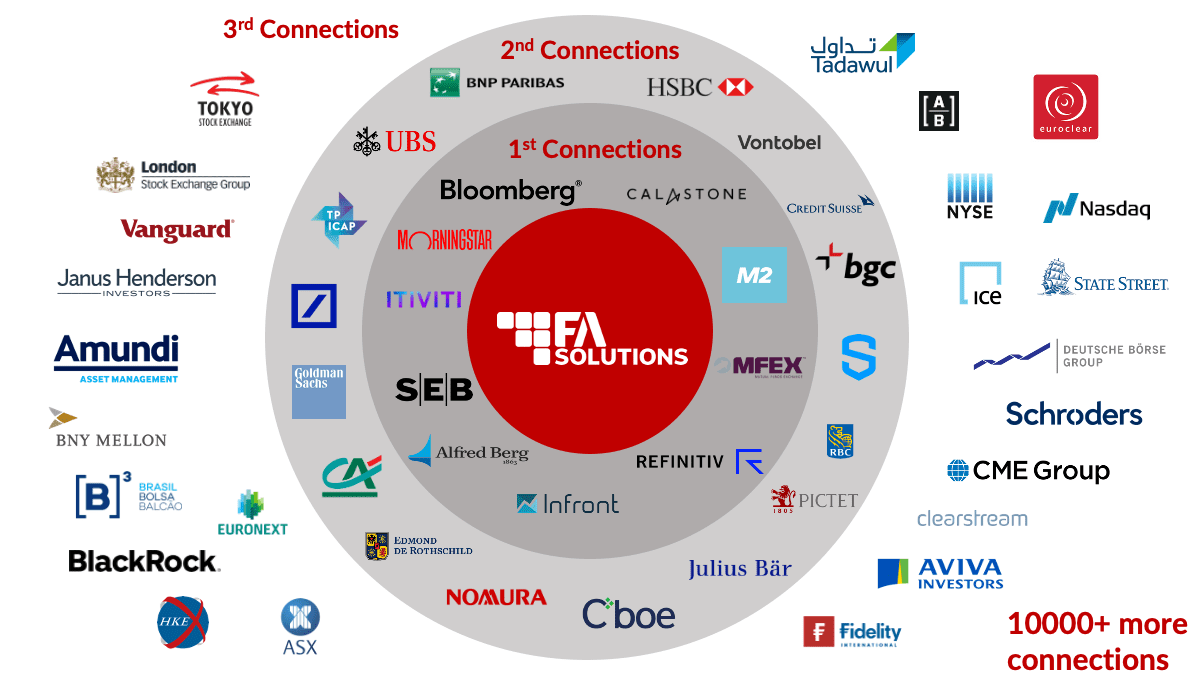

Examples of FA's connections

Watch the “Integrating FA with External Platforms” webinar recording. If you wish to learn more - kindly contact us and we will guide you through.