Investment managers are evaluating how to leverage technology to offer a differentiated service and improve the customer experience. FA Solutions shares insights on how we connect to external platforms for a cost-effective route to digitising wealth management.

The case for digitisation

There is a misconception that digital platforms need to replace legacy systems and consolidate functions. No single provider offers expertise across all functions to streamline workflow. FA’s modular nature automates functions in the background and sends data to an external layer or vice versa, which could be an inhouse or third party platform that is more cost-effective. For example, FA’s bookkeeping module can connect to an accounting system that provides a more comprehensive outcome. Integrations are powered by APIs, an interface that communicates with other systems to send or retrieve data.

Testimony from Centology

FA’s strength lies in middle and back office functions such as rebalancing. By focusing on their strength, Centology has the flexibility to scale their client base to tens of thousands whilst minimising underlying costs. This can be achieved by automating functions provided by FA, which includes generating trade orders in FA, updating transactions from a custodian and feeding portfolio positions back to Centology.

Future of Wealth Management

As wealth managers integrate with best-in-breed systems to increase automation, they have the flexibility to adapt to new technology. This opens a new conversation on the limitations of human input by embracing AI and machine learning. For example, FA has explored its use in anti-money laundering, being able to search through very large sets of data to detect anomalies at a much faster rate than humans can. In conclusion, FA envisages future wealth managers being less reliant on outsourcing services and migrating data and technology to the cloud.

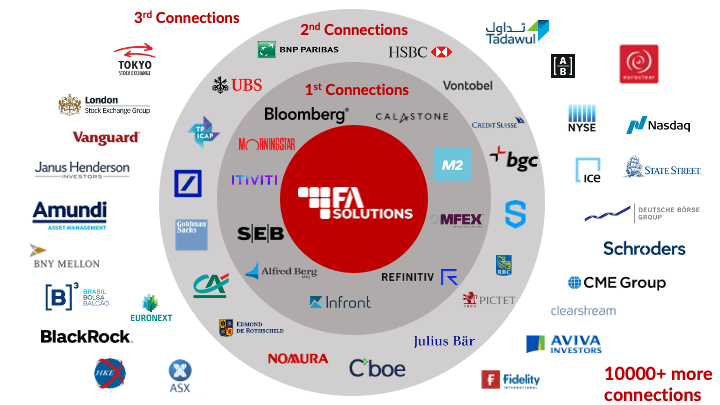

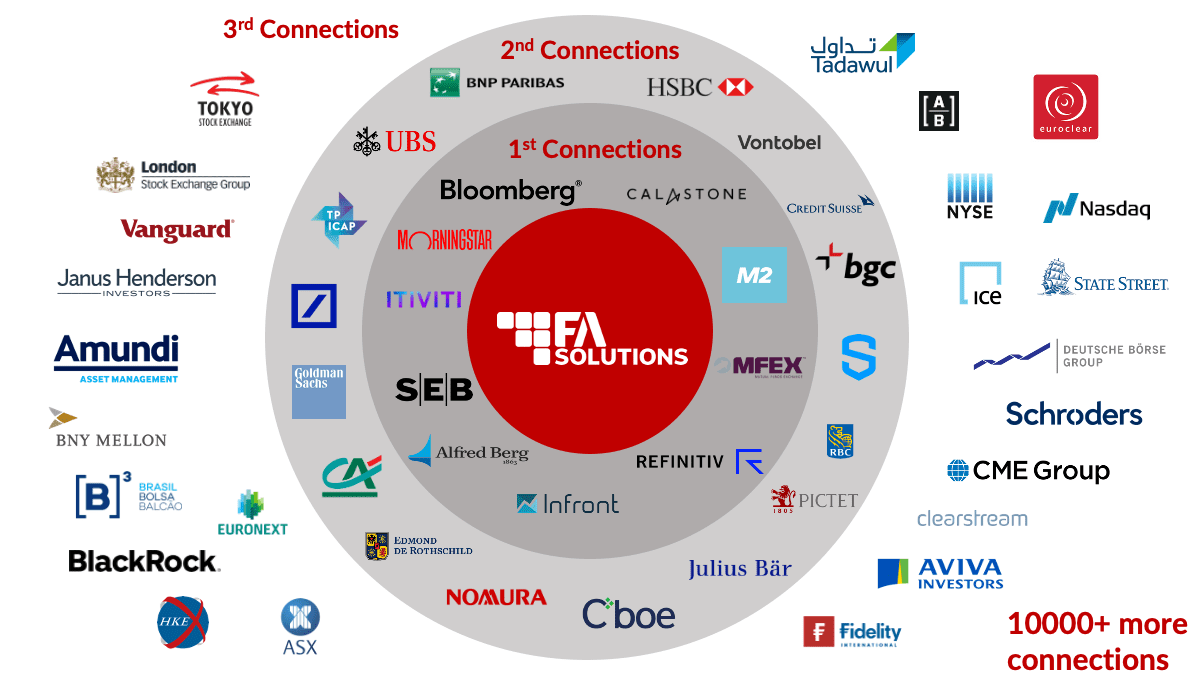

Examples of FA's connections