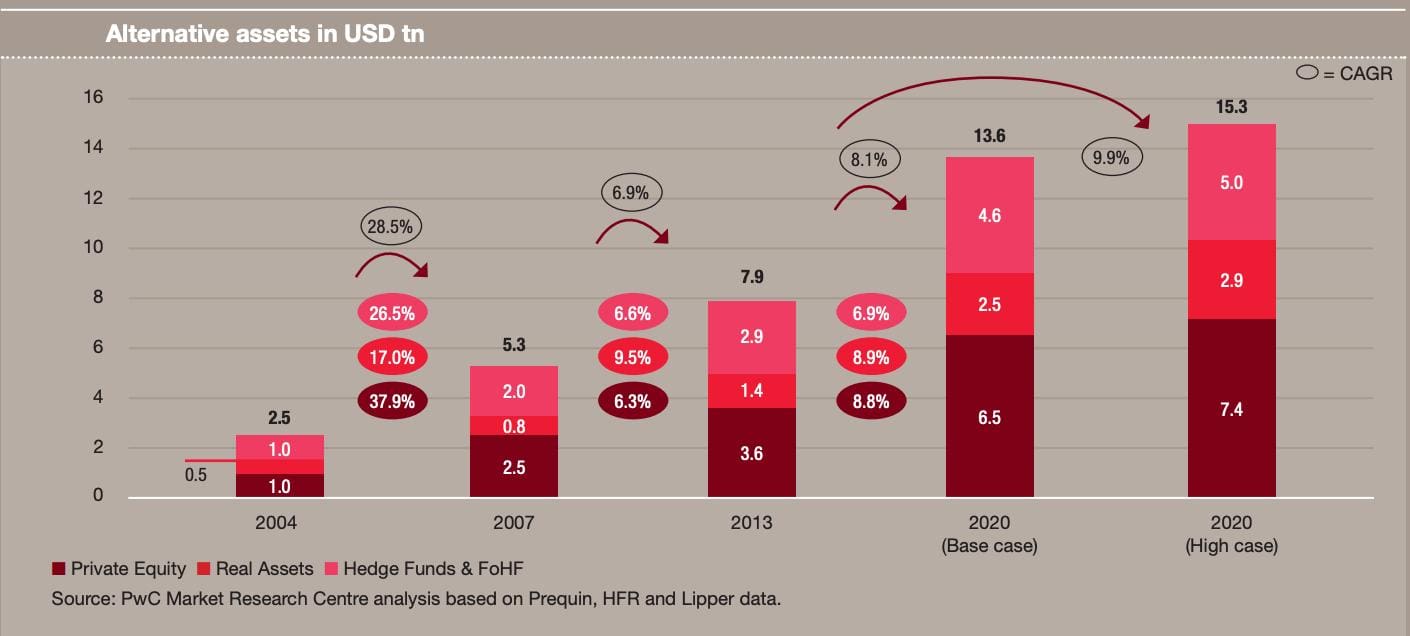

Alternative assets distribution chart from the “Alternative asset management 2020” report by PwC1

Private equity (PE) is one of the primary alternative asset types at the moment, as seen in the PwC chart above. This is certainly tied to the outstanding rate of return associated with this investment class. According to the UBS/Campden Wealth “Global Family Office Report” published in 20192, “Private equity fared the best of all asset classes in 2019, achieving an average return of 16% for direct and 11% for funds-based investing.”

While PE is certainly promising from the perspective of the investor, Wealth Managers often struggle with how private equity can be valued and reported on efficiently.

“Private equity is very much an operational maze. It is manual from the outset, with PDFs in emails or fund-specific logins to access valuations, transaction details, etc. There is little standardisation even in terminology. Some funds operate with opaque transaction types, often with strings attached, such as recallable distributions. That this is not under more scrutiny, criticism or regulatory follow-up is probably only caused by reasonably decent returns and ‘professional’ investors,” – comments Hjalmar Bøe, ex-head of Compliance & Middle Office at Höegh Capital Partners, currently running his own investment advisory helping Family Offices Yalmar, which is currently using FA Platform.

“These operational and governance issues aside, private equity has been an excellent asset class to be involved in, and much can be done on the buy side to increase efficiency. Our main criteria when choosing FA Platform was to get a Portfolio Management system that could handle all investments across our wide range of instrument types,” – he concludes.

As Hjalmar explained, managing PE in general and receiving private equity transactions in particular is still a lengthy process. However, once the information is clear, the recording or importing of the data is a streamlined process with FA Platform. We have created specific PE parameters using our extensive experience to modernise the entire workflow.

The process begins with our PE dedicated transaction types. These transaction types have an extra parameter for recording the effects of commitment in relation to their cash effect – specifically whether or not they add or reduce cash and commitment. Each type of transaction has 21 different parameters for defining the effects, which a user can create or modify as they see fit. Good examples are distribution and recallable distribution – one adds cash, while the other adds return – these are completely configurable by the user.

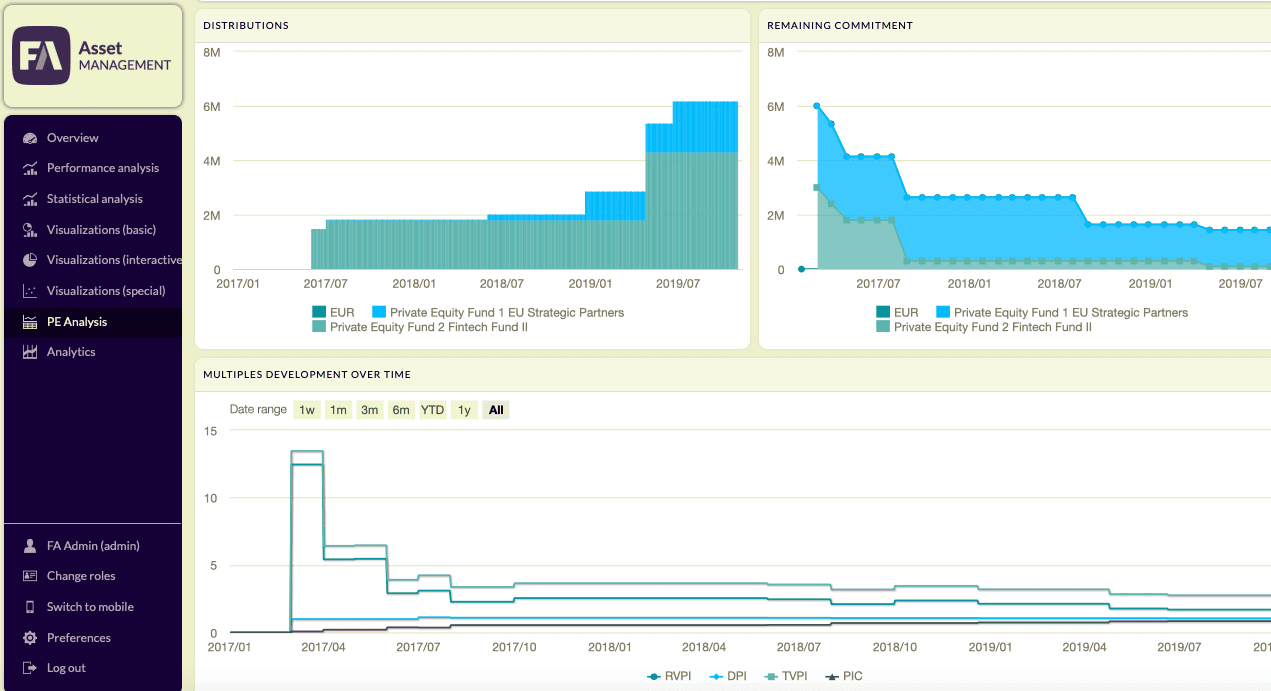

Private equity analysis view in FA Front

Once the transactions have been recorded within the FA Platform, that is when the true power of our PE capabilities start to shine in the Analytics module. This module calculates over 500 different performance ratios, metrics, and figures, including more complex PE figures, all in real time and using GIPS standards:

• Committed capital

• Remaining commitment

• Distributions

• Paid In Capital

• IRR (Internal Rate of Return)

• DPI (Distributions to Paid In Capital)

• PIC (Paid In Capital to Committed Capital)

• RVPI (Residual Value to Paid In Capital)

• TVPI (Total Value to Paid In Capital)

And if you wish to learn more about solving the challenges of managing alternative investments, such as private equity, luxury items, art, and collectibles, make sure to register for our upcoming webinar about this topic.