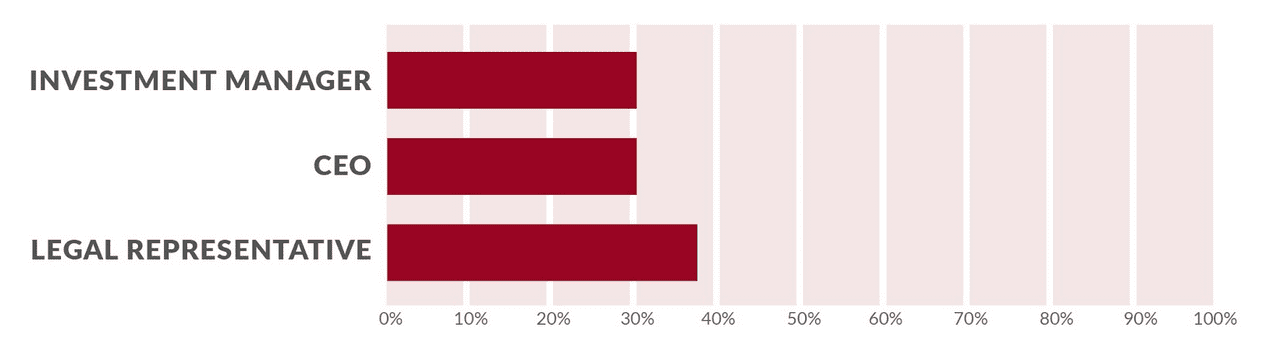

FA Solutions carried out a research to find out the most important key figures and risk indicators in pension funds sector. Answers were collected via an electronic survey which was performed in Finland. It was sent to 19 Finnish pension funds in the field of statutory pension security and to 5 pension funds in the field of supplementary pension benefits. We received 14 replies during the two weeks when the survey was open. Survey respondents were investment managers, CEOs, and legal representatives of Finnish pension funds.

On the basis of the research we created order of precedence for both key figures and risk indicators.

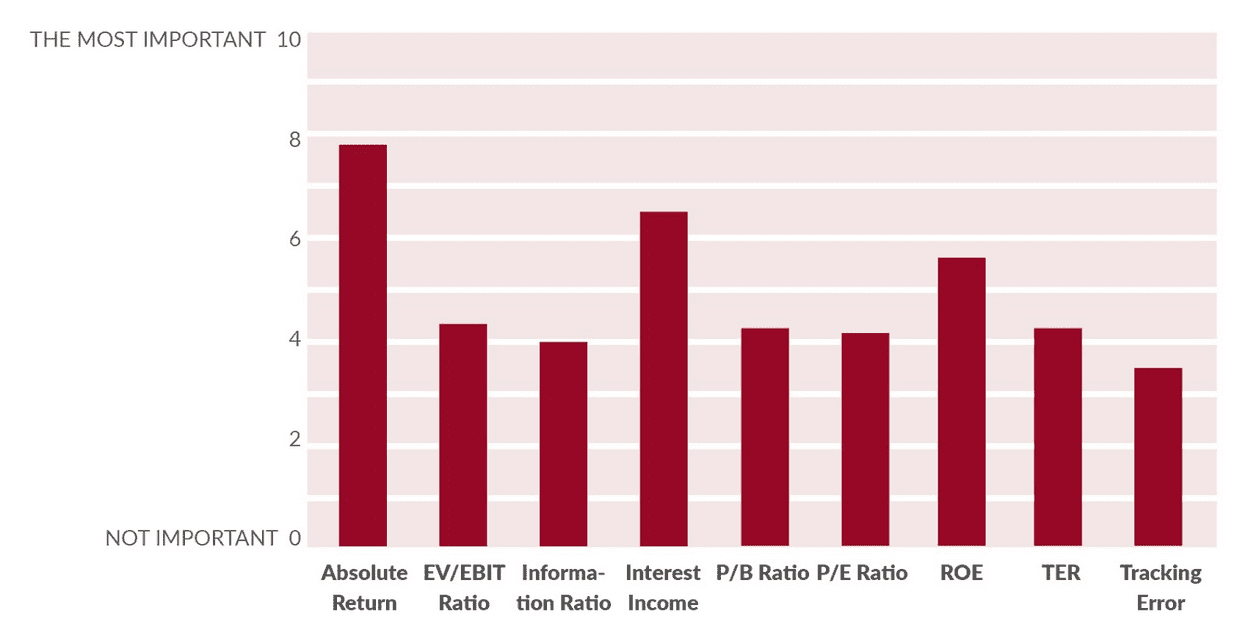

The most important key figure was Absolute Return, followed by Interest Income and ROE. EV/EBIT Ratio, P/B Ratio, P/E Ratio and TER Ratio got almost the same rates after top three. Tracking error was the least used figure.

71% of respondents chose Absolute Return as the number one so it was clearly the most important. It wasn’t that clear with other figures since replies were diverging around the value chart. Based on that, we can conclude that most probably the importance of key figures differs depending on the foundation we’re looking at.

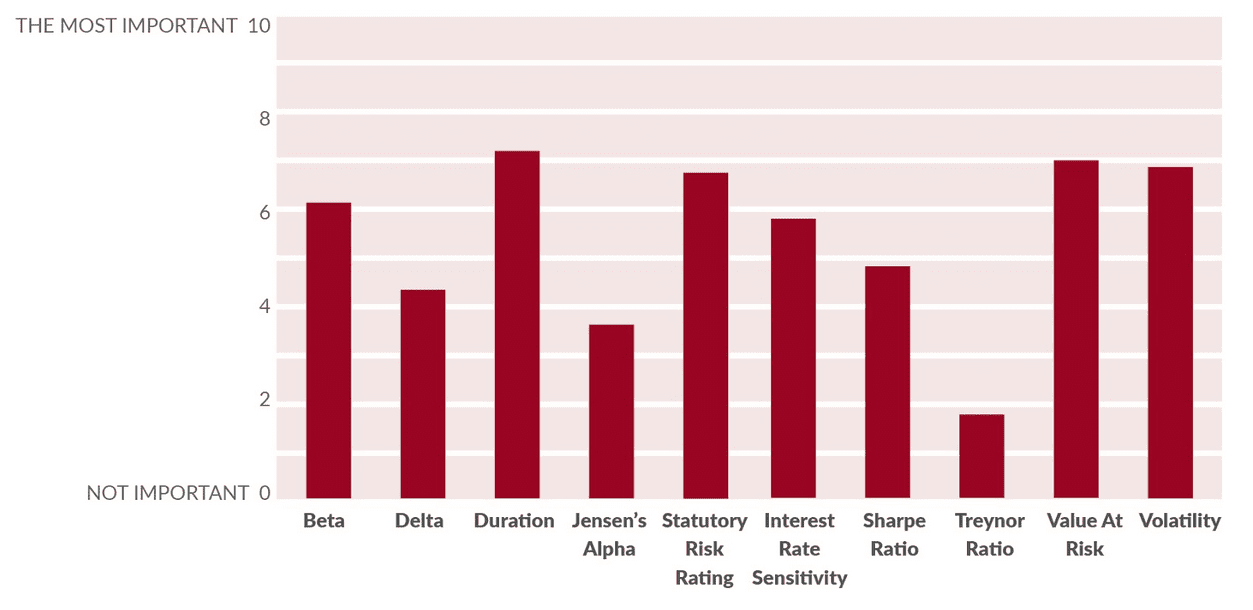

The most important risk indicator was Duration, followed by almost equally important Value At Risk, Volatility and Statutory Risk Rating. Next ones were Beta and Interest Rate Sensitivity. The least used tools were Sharpe Ratio, Delta, Jensen’s Alpha and Treynor Ratio (ordered by importance the last one being the least important).

There was a lot of diverging opinions. Respondents agreed more on the least important tools than the most important ones. Generally, almost in all cases the top 5 and bottom 5 lists included the same tools but just in a different order, depending on a foundation.

We also asked if pension funds follow other figures or indicators that were not included in the survey. 21% of respondents agreed doing that and mostly they commented to follow different indicators of solvency.

What can we learn from the study? Pension funds are interested in using figures and indicators to assess their investments. Nevertheless, one can not consider pension funds being identical: They are interested in different key figures and risk indicators which communicates different investment habits.