The global economy is experiencing one of the most complex issues of our time and it is without a clear solution. It can be described as Gordian Knot for economists, analysts, and portfolio managers. How is the novel coronavirus going to affect the global economy and your portfolio?

The complexity of forecasting the effects arise from the possible direct and indirect impacts. The direct impacts are mostly attributed to lack of personnel and decrease in demand for products. However, the indirect consequences are much more diverse e.g. supply chain interruptions, travel restrictions, cancelled events, and shortage of basic goods. Performing an analysis of the conditions are next to impossible when the availability of reliable data is low and the accuracy of existing data is being questioned. That leaves the timeframe and magnitude of the disaster as one big question mark.

Direct and Indirect Ripples

In times like these, it’s difficult to keep your feet dry, so it all comes down to risk mitigation. The mitigation process starts by identifying the assets and investments that are exposed to the event directly as well as ones may be indirectly exposed. Naturally, it is not an easy feat to pinpoint all the direct and indirect effects, but some sectors, countries, and industries can be assumed.

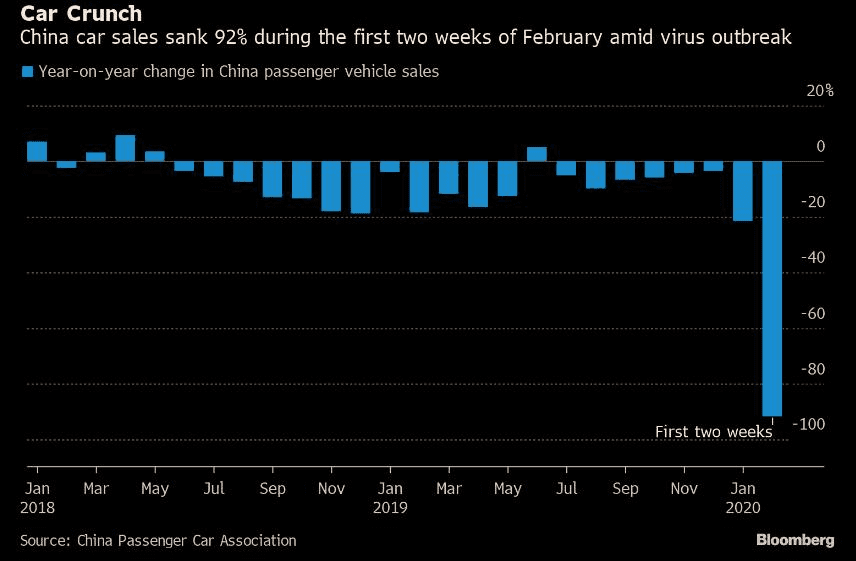

For example, aviation and car manufacturing in China are more exposed than software and energy industries in China. Therefore, the more reliable basic information you possess about what is currently happening with companies or sectors that you are invested in and their correlations, the deeper you can go with analysis. This analysis should help you to formulate possible scenarios and outcomes for your investment strategy and those scenarios can be refined once new information becomes available.

Even though the global economy has not seen a virus of this magnitude for some time, it has experienced other market shocks or even “black swan” events recently. The potential investment losses can be mitigated with similar data backed risk management measures as used in previous market shocks. Hence, you need to have the right information available immediately when it is needed. Hopefully this way you can spot your exposures ahead of time instead of identifying them based on plunging return figures.

In the coming months we will start to see the ripple effect of this new pandemic on both the demand and supply side. However, the industries most affected are difficult to forecast without the reliable data. Since the available data is believed to not be reliable, the next measurement asset managers should be looking at is Liquidity.

Liquidity

When Black Swan events occur the liquidity characteristics of an investment become crucial. If you are not willing to accept fire sale prices, liquidity becomes even more crucial. Naturally each investment sector has their own benchmark of liquidity. However, the majority of investments in modern finance is either in or through different types of funds.

Imagine a circumstance where there is a large volume of sell orders on a blue-chip stock that is overlaid and over exposed in countless funds. These funds will try to protect their YTD (Year-To-Date) returns and prospectus cash allocation. Which could trigger a dip in market sentiment, leading to retail investors redeeming fund shares, which would imply that fund managers must sell select positions at a potentially bad rate just to ensure they remain liquid to more redemptions. This would create a self-fuelling sell cycle destroying liquidity in the market and erasing years of returns.

European Securities and Markets Authority (ESMA) has released new guidelines on liquidity stress testing in UCITS (Undertakings for the Collective Investment in Transferable Securities) and AIFs (Alternative Investment Fund). ESMA expects the Guidelines to be applied by 30th of September 2020. Within the guidelines they do not clearly state how liquidity should be calculated and reported, but they layout the framework of how to approach liquidity.

If you would like to know more about the new ESMA regulation, join us at our afternoon seminar on March 19th at 14:00. We will be hosting the event together with our legal partner, Lexia, in Helsinki.