On May 30th, 2023, the Dutch Senate adopted a legislative proposal called “Wet toekomst Pensioenen (Wtp)”. The new pensions act requires Dutch pension funds to radically change their administrative processes and IT. Tjitsger Hulshoff, former Wtp – quartermaster at APG, argues that pension funds should set up a (virtual) Middle Administration function for the purpose of implementing Wtp. A Middle Administration allows pension funds to establish the required link between their Pension Administration and their Investment Administration. The imminent conversion of the Dutch pension system has been called by some as “the biggest IT intervention in a pension system ever”.

- Wet toekomst pensioenen (Wtp)

Wtp will form the basis for a number of essential changes in the Dutch pension system, which must be introduced by the Dutch pension funds by January 1st, 2028 at the latest.

Under Wtp, the current Dutch Defined Benefit system will be abolished. In the second pillar of the Dutch pension system, all pension fund participants will receive an individual investment pot, instead of a pension promise depending on the amount of their salary. The amount of the pension entitlement per participant under the new Wtp will depend strongly on the investment returns of this individual investment pot. In a sense, the Dutch pension funds will collectively switch from DB (Defined Benefit) to DC (Defined Contribution).

Under Wtp, pension funds can choose between offering a Social Premium DC – Scheme (SPR) or a Flexible Premium DC – scheme (FPR).

Pension funds that offer the SPR scheme will generally allocate their collective period returns to the individual participants by means of a calculation rule (decomposition). Pension funds that offer the FPR scheme will generally allow participants to invest in an individual mix of investment funds (unitization).

2. Challenges of Wtp: aligning processes and IT systems

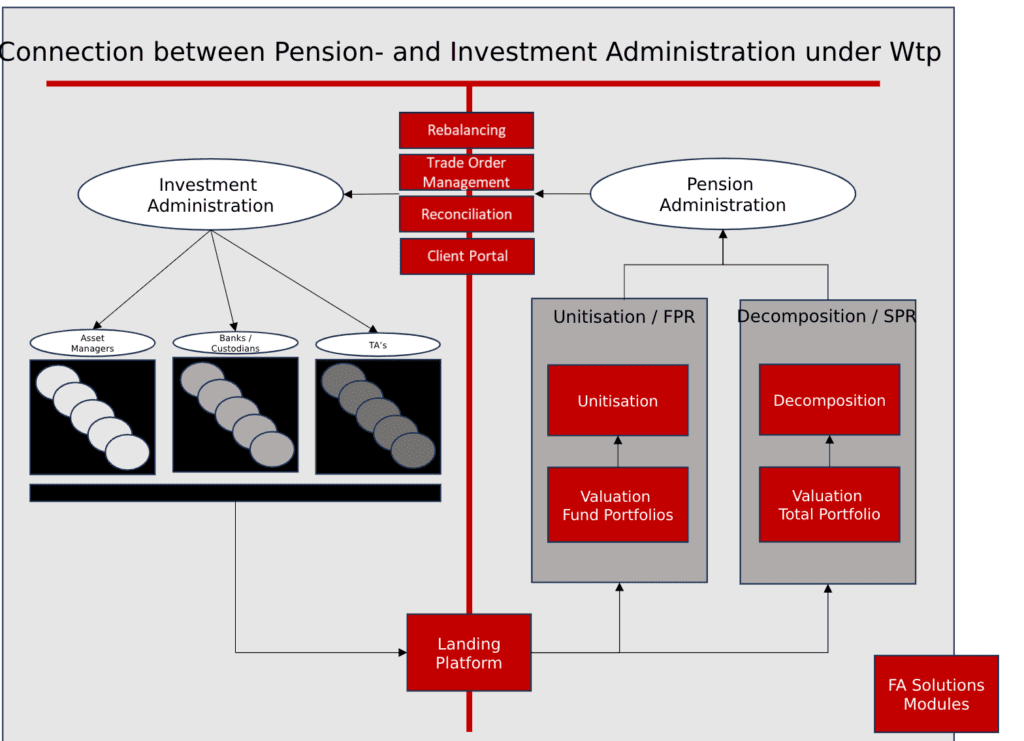

The transition from Defined Benefit to Defined Contribution is complex and requires a drastic change in the operational activities of Dutch pension funds. That is, because, in a DB system the Investment Administration and the Pension Administration of the pension fund can in principle function completely independently of each other. In a DC system, the two administrations have to form one integral chain.

It is now becoming clear that many pension funds that have not yet integrated their two administrations are indeed choosing to establish the necessary link by setting up a (virtual) Middle Administration. The unitization or decomposition can take place within the Middle Administration. In addition, the Middle Administration can form the platform for executing the participant-related investment cycle, which is expected to run on a monthly basis.

Below we highlight some key functions of the Middle Administration.

2.1. Acting as a Landing platform for decomposition under the SPR

An important role of the Middle Administration in an SPR scheme can be to act as a “Landingplatform” for data originating from the pension fund’s Investment Administration. The Middle Administration oversees the fast, reliable and controlled collection, standardization and registration of all data at the beginning of the month and at the end of the month.

Based on the retrieved data, the pension fund’s monthly investment return in Euros can be calculated, after which it will be distributed to the individual participants on the basis of a set of fixed calculation rules.

2.2. Acting as a Landing platform for unitization under the FPR

Pension funds that offer the FPR scheme generally will allow participants the possibility to invest in an individual mix of dedicated investment funds.

Here as well, the Middle Administration oversees, on a monthly basis, the fast, reliable and controlled collection, standardization and registration of relevant investment data. Based on the information collected, the Net Asset Value (NAV) for each investment fund offered can be calculated.

By dividing the NAV by the number of units as recorded in the pension fund’s Unitholder Registry, the market value of the individual investment pots can be determined in the Middle Administration. This allows for further processing within the Pension Administration and for communication with the associated participants.

2.3. Rebalancing, Trade Order Management and Reconciliation

The Middle Administration also can provide the basis for executing the participant-related investment cycle, which will be done on a monthly basis.

An essential task for the Middle Administration under the FPR scheme is to ensure the periodic rebalancing of the mix of units in the pension pots of the individual participants. Rebalancing is required due to monthly premiums paid in, pension payments paid out and/or changes in the market value of the underlying investment funds.

The Middle Administration ensures the rebalancing is carried out by passing on purchase and sale instructions to the asset managers of the pension fund. The pension fund’s asset managers will undertake the process of creating purchase and sale trade orders in the marketplace.

In order to guarantee the correctness and completeness of the data, all purchase and sale transactions in the Middle Administration must be reconciled with the purchase and sale invoices of the asset managers.

2.4. Taking care of communication with the participant

Another important role of the Middle Administration can be to provide a Client Portal that takes care of communication with the pension fund participants.

Through this Client Portal, participants can report changes (for example, new joiners and leaving employment, changes in their risk profile, withdrawal of funds etc.) to the pension fund and can also receive information about the size, composition, return and risk profile of their investment pot.

3. The FA Platform: the ideal IT solution for a Middle Administration

The Dutch Central Bank DNB (supervisor of Dutch pension funds) has recently published in a report that as of mid-2023, almost one in three pension funds have not yet an agreement with service providers regarding the establishment of a Middle Administration.

In that same report, DNB published that in mid-2023, about half of all pension fund board members (49%) indicated that they consider the lack of the right Information Technology to be a possible bottleneck for the establishment of the Middle Administration.

FA Solutions (www.fasolutions.com) offers pension funds the required technology to support the Middle Administration both for SPR and FPR schemes.

The FA Platform is a fully cloud-based SaaS solution running on micro-services with an open-ended architecture, allowing pension funds to connect, leveraging on open APIs, their Middle Administration to other applications within their IT ecosystem.

Hosting is provided by Microsoft Azure and management and maintenance of the platform is overseen by FA Solutions.

Being cloud native, FA Solutions allows users to benefit from a low cost of ownership, as no physical on-premise servers are needed. Data integrity with no lag to retrieve data is also native as all data is in one location.

FA Solutions offers a transaction-based platform that has unrivaled asset-class coverage. In addition, it offers a digital client portal for end clients, accessible from any device, allowing pension fund participants to take note of the contents of their pension pot at any time and at any desired location.

Are you considering setting up a Middle Administration? Are you otherwise interested in the solutions of FA Solutions to boost your Investment Management Business?

Call or email for an appointment. Telephone: 06-551.20.366. Mail: roger.bastings@fasolutions.