The FA Fund Management application streamlines workflows to calculate NAVs and maintain shareholder registries. It provides you with a modern, effective tool to manage a large number of funds, including mutual funds, hedge funds, and private equity funds. It can handle various types of assets, share classes in different currencies, and complex fee structures. This blog post will inform you about the latest updates and improvements to the FA Fund Management application showing how to make your workdays with funds smoother.

The Fund Management functionality has been available in the FA Platform for a long time already. In June 2020, it was upgraded into a separate FA Fund Management application to re-think and refine the main workflows and improve usability and user experience. You can read here how we enhanced the FA Fund Management application again last year (version 1.1) and added completely new functionality such as grouping funds, mass calculating funds or groups of funds, and adding NAV schedules.

In January 2022, we released the FA Fund Management version 1.6. and now, we want to introduce you to the most significant new features and improvements that have been released after the FA Fund Management 1.1, in other words, after last summer. These include support for rolling back NAV, tools for following NAV calculation and meeting compliance requirements, the calculation flow to help you see which funds are in queue to be calculated or accepted, and improvements in the Shareholder registry.

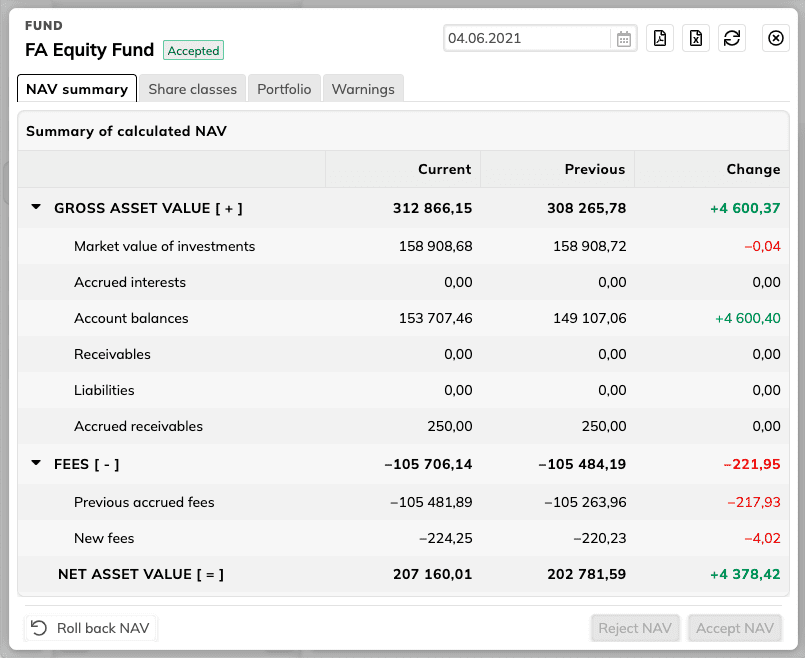

Rolling back NAV is now possible in the FA Fund Management

The FA Fund Management version 1.4 introduced easily rolling back NAV as a new feature. The rolling back function allows you to delete or erase a NAV you’ve already accepted and ensures all data is returned to what it was before calculation. This is a helpful tool if, for example, you have accidentally accepted NAV with incorrect values or for wrong dates. Before, rolling back required going through a long list of manual steps – now you can roll back the latest accepted NAV with a click through the NAV window.

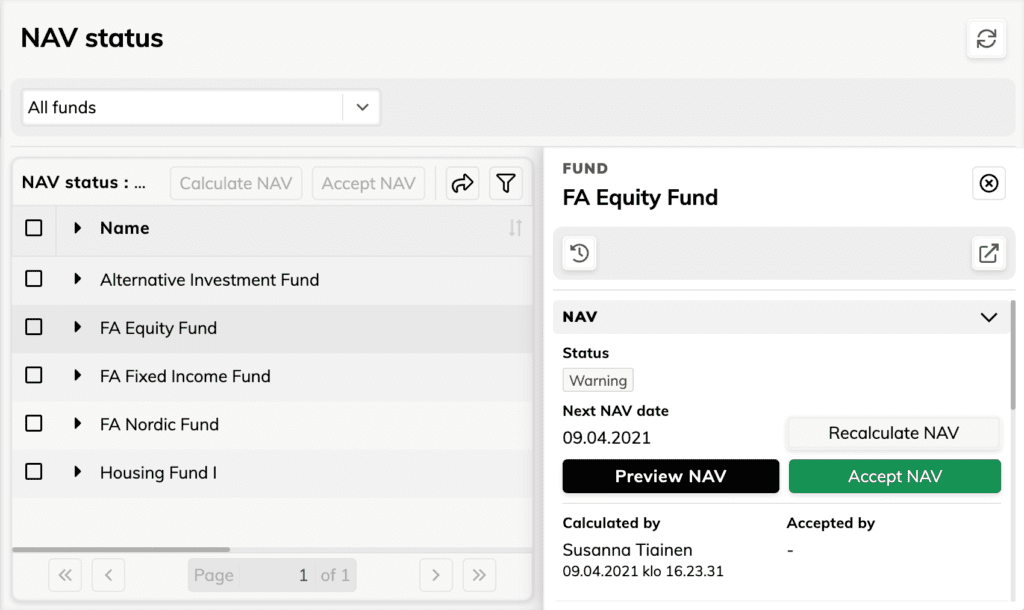

New tools for following NAV calculation and meeting compliance requirements

The FA Fund Management application now includes tools to facilitate following NAV calculation and meeting compliance requirements.

You can now see who calculated and accepted the latest NAV, including a time stamp on when the calculation or acceptance was done. This allows you to quickly follow up which users have interacted with your fund to calculate or accept NAV and to see when these actions have been done. For example, you can use this information for compliance purposes or to ensure calculations have been done and accepted on time by the correct employees.

Also, fund details in the NAV status now allow you to see the audit history for the fund. This new window allows you to see the user audit logs generated by the system related to your users interacting with your funds. The audit history allows you to, for example, see which users calculated or accepted NAV on the fund and when, including the calculation or acceptance log. The audit history provides you with tools for investigation and troubleshooting: if you need to figure out what happened with your fund, the audit history provides you with information on who, when, and what.

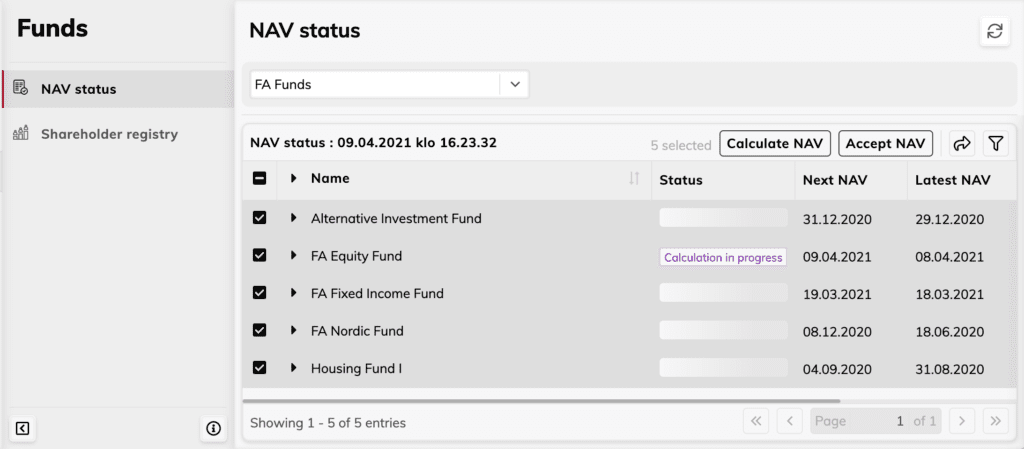

Calculation flow: see which funds are in queue to be calculated or accepted

Fund’s Status in the NAV status screen in the FA Fund Management now indicates when a fund is “in queue” to be calculated or accepted. Showing the funds that are in queue provides great help for using the features to mass-calculate or mass-accept NAV – the fund listing now clearly indicates which funds were initiated with a mass-calculation or mass-acceptance but haven’t yet been processed. The “in queue” indication provides you with more visibility on your NAV calculation and acceptance and ensures you stay on top of what is going on with your funds. For example, this helps you not to unnecessarily trigger mass calculation or mass acceptance on the same fund multiple times.

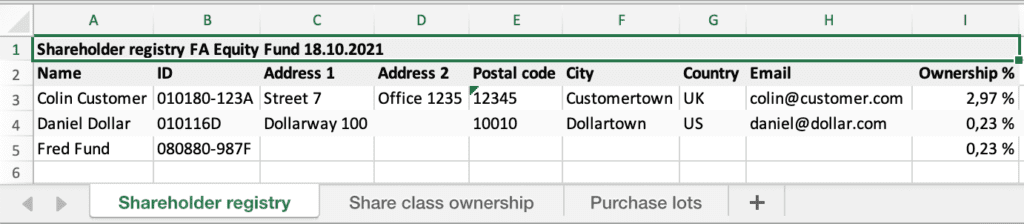

Improvements in the Shareholder registry

We have also introduced several improvements in the Shareholder registry, for example viewing shareholders for a certain date and an improved structure of Shareholder export.

The Shareholder registry in the FA Fund Management now allows you to select the date for which you want to view your fund’s shareholders. This allows you to easily go back in time to see your shareholders and their ownership for a specific date in history, for example at the beginning of the year. Shareholder export also reacts to your selected date, allowing you to extract the information visible on the screen.

The Structure of the Shareholder export report has been clarified and improved for providing better support for enriching the data further with a spreadsheet. The data is now divided into three different sheets with a flat structure: The first sheet provides you with a Shareholder registry, listing your shareholders with their ownership and address details. The following sheets contain Share class ownership and Purchase lots, providing you with more details on which share classes each shareholder owns and how they’ve purchased them.

We have also made a bunch of smaller yet very useful improvements and bug fixes in every FA Fund Management version largely based on customer feedback, and we will keep doing so. With us taking care of constantly re-thinking and refining our FA Fund Management application, you can be at ease knowing you have full, up-to-date coverage for handling funds within FA.